Order Execution

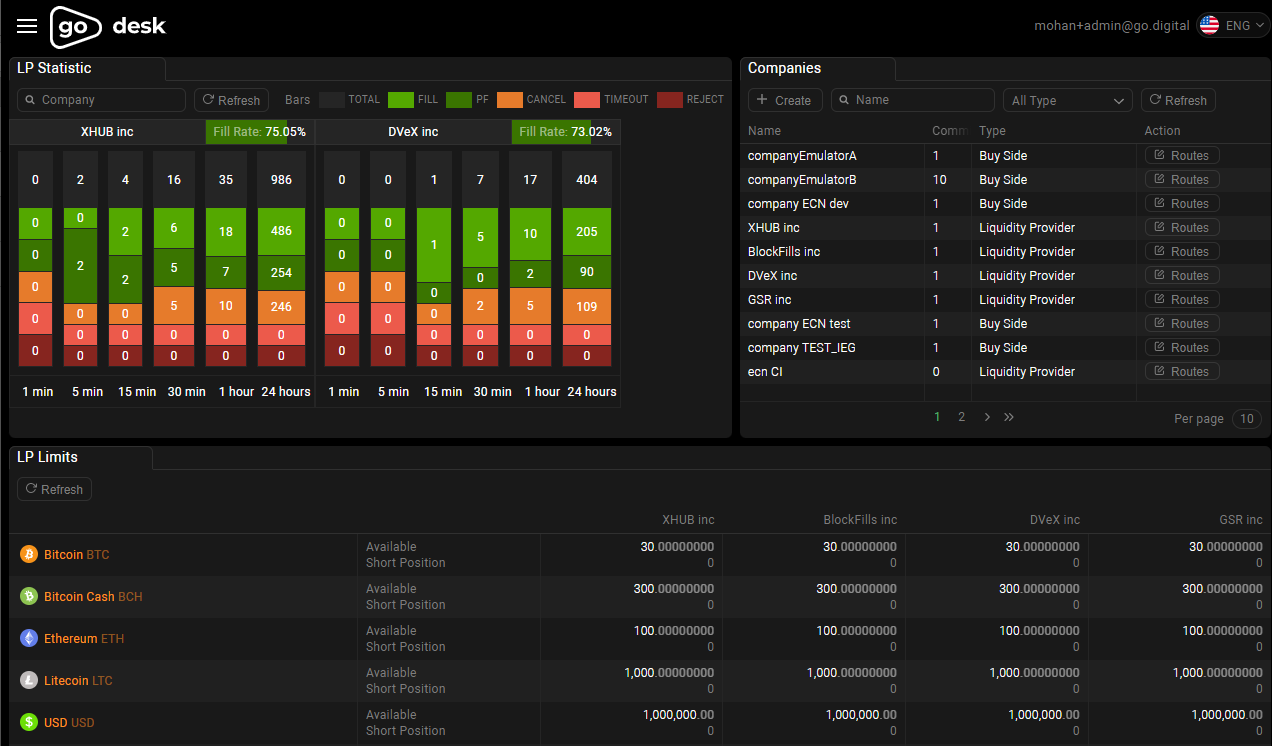

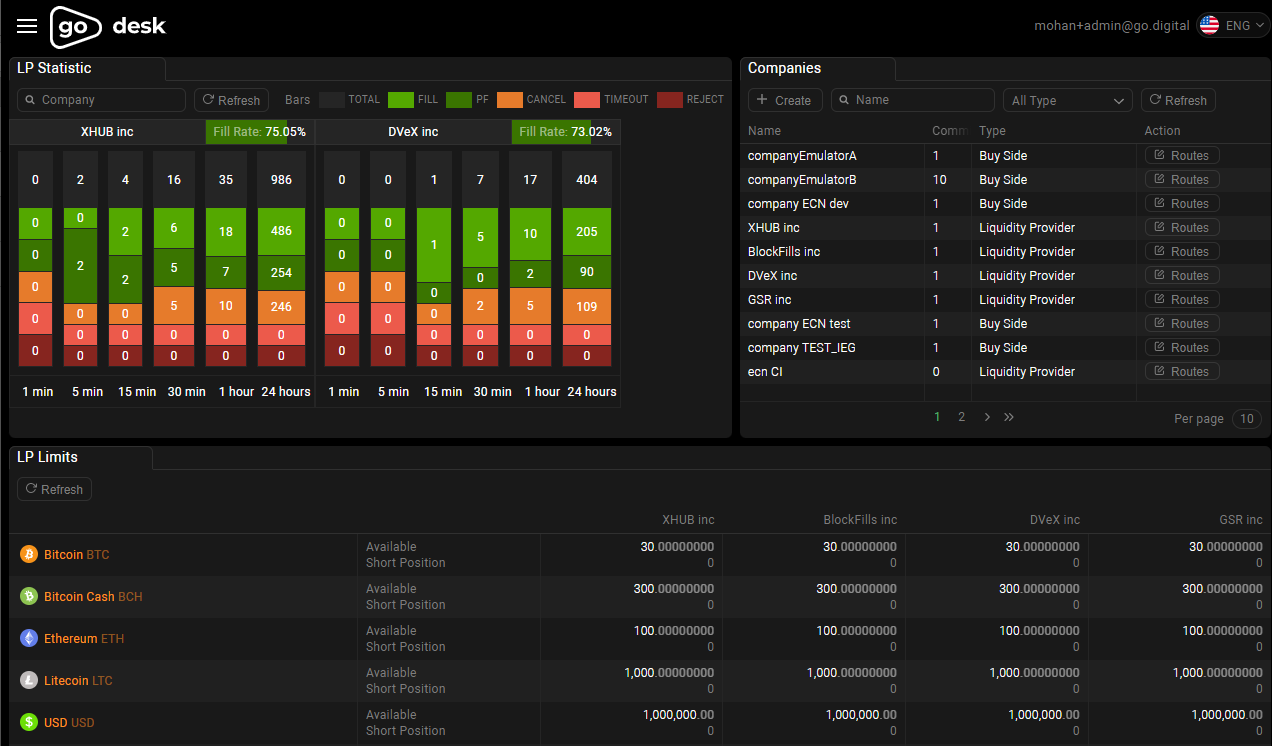

Access institutional liquidity to achieve best size and price.

Access deep liquidity, and block trading through robust API connectivity.

GO Digital's dark pool provides institutions with the ability to access markets without moving price.

Our liquidity providers are comprised of Miners, Exchanges, Market Makers, Liquidity Pools, and Institutions to ensure 99.99% uptime reliability.